The Kelly Criterion, also known as the Kelly formula or Kelly strategy, is a mathematical formula used to determine the optimal size of a series of bets or investments. It is a popular approach among professional gamblers and investors, as it seeks to maximize the long-term growth of capital by determining the optimal fraction of wealth to be risked on each bet or investment. In this article, we will delve into the history and background of the Kelly Criterion, discuss its use in various applications, and provide examples and statistics to illustrate its effectiveness further.

History and Background

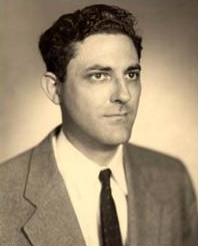

The Kelly Criterion was first published in 1956 by John L. Kelly Jr., a physicist and information theorist who worked at AT&T’s Bell Laboratories. Kelly’s work focused on optimizing information transmission over a noisy channel. He developed the formula to maximize the long-term growth rate of capital when making bets with a positive expected value.

The Kelly Criterion gained popularity among professional gamblers and investors in the following years. Edward O. Thorp, a mathematician and pioneer in quantitative investing, is often credited with popularizing the use of the Kelly Criterion in gambling and finance. Thorp’s 1962 book, “Beat the Dealer,” introduced the concept of card counting in blackjack and demonstrated how the Kelly Criterion could be applied to optimize betting strategies.

Interesting Facts

The Kelly Criterion is sometimes called the “geometric mean maximization” strategy, as it aims to maximize the geometric mean of the outcomes, which is directly related to the long-term growth rate of capital. While the Kelly Criterion is primarily used in gambling and finance, it has also been applied in other fields such as telecommunications, data compression, and machine learning. Many famous investors, such as Warren Buffett and Bill Gross, have used the Kelly Criterion. Although they may not adhere strictly to the formula, their investment philosophies often reflect the core principles of the Kelly approach.

Understanding the Kelly Criterion

The Kelly Criterion formula can be expressed as:

f* = (bp – q) / b

Where:

- f* is the optimal fraction of capital to be risked on a bet or investment,

- b is the odds received on the bet (decimal odds – 1),

- p is the probability of winning the bet, and

- q is the probability of losing the bet (1 – p).

The formula is designed to calculate the optimal bet size that will maximize the expected logarithm of wealth, which is equivalent to maximizing the long-term growth rate of capital. By adjusting the bet size according to the odds and probabilities, the Kelly Criterion helps to minimize the risk of ruin (i.e., losing all money) while maximizing the potential for exponential growth.

Python code example to illustrate how to use the Kelly Strategy

| def kelly_criterion(odds, probability): “”” Calculate the optimal bet size using the Kelly Criterion. :param odds: The odds of the bet, i.e. the potential payout multiplier (including the original stake) :param probability: The probability of winning the bet (between 0 and 1) :return: The optimal fraction of the bankroll to bet (between 0 and 1) “”” return (odds * probability – (1 – probability)) / odds def main(): # Example bet with 1.5 odds (meaning a 50% profit if won) and a 60% estimated probability of winning odds = 1.5 probability = 0.6 kelly_fraction = kelly_criterion(odds, probability) print(f”The optimal bet size as a fraction of the bankroll is: {kelly_fraction:.2%}”) if __name__ == “__main__”: main() |

This code defines a function kelly_criterion that takes the odds and the probability of winning as input and returns the optimal fraction of the bankroll to bet. The main function demonstrates how to use the kelly_criterion function with an example bet.

Applications of the Kelly Criterion

- Gambling. – Professional gamblers widely use the Kelly Criterion in games like blackjack, horse racing, and sports betting. By adjusting the bet size based on the odds and the bettor’s edge, the formula can help to minimize the risk of ruin while maximizing the potential for long-term profits. For example, in blackjack, card counters use the Kelly Criterion to determine the optimal bet size based on the current count and the remaining decks.

- Investing. – The Kelly Criterion can also apply to investing. The formula can determine the optimal capital allocation to different stocks or investment opportunities in the stock market based on their expected returns and risk profiles. Many quantitative investment strategies, such as portfolio optimization and asset allocation, incorporate the principles of the Kelly Criterion to maximize risk-adjusted returns.

Examples and Statistics

Edward O. Thorp’s groundbreaking work on card counting demonstrated the effectiveness of using the Kelly Criterion in blackjack. In his book “Beat the Dealer,” Thorp showed that a skilled card counter with a 2% edge over the casino could double their initial bankroll with a 95% probability by following the Kelly strategy. Over many bets, the Kelly bettor’s capital would grow exponentially faster than a gambler using a fixed bet size or other betting strategies.

Using the Kelly Criterion in Blackjack: Facts and Strategies

The Kelly Criterion is widely used in blackjack to optimize betting strategies, particularly with card counting techniques. Card counting is used to gain an advantage over the casino by tracking the ratio of high and low cards remaining in the deck. When the proportion of high cards is higher than usual, the player has an edge, and vice versa. The Kelly Criterion helps players adjust their bet sizes based on this edge, minimizing the risk of ruin while maximizing long-term growth.

Here’s a more detailed explanation of using the Kelly Criterion in blackjack:

Establishing the player’s edge

Before applying the Kelly Criterion, the player needs to determine their edge over the casino. It can be achieved through card counting methods like the Hi-Lo system, where each card is assigned a point value, and the running count is updated as cards are dealt. The player’s edge is typically calculated as a percentage, indicating how much they can expect to win over the long run.

Calculating the actual count

The running count must be converted to the exact count to account for the varying number of decks used in blackjack games. The accurate count is calculated by dividing the running count by the remaining number of decks in the shoe. It provides a more accurate representation of the player’s advantage.

Determining the optimal bet size

With the actual count, the player can apply the Kelly Criterion formula to calculate the optimal bet size. The formula is:

f* = (bp – q) / b

where:

- f* is the optimal fraction of the player’s bankroll to be risked on the next hand,

- b is the odds received on the bet (decimal odds – 1),

- p is the probability of winning the hand, and

- q is the probability of losing the hand (1 – p).

The odds (b) are typically even money (1:1) in blackjack, meaning that b = 1. To estimate the probability of winning (p), the player can use their edge over the casino derived from the accurate count. For example, if the player has a 2% edge, p = 0.52, and q = 0.48. The optimal bet size (f*) can be determined by plugging these values into the formula.

Adjusting the bet size

The player should adjust their bet size according to the optimal fraction (f*) calculated using the Kelly Criterion. When the player has an advantage, they should increase their bet size, and when the casino has a gift, they should decrease their bet size or refrain from betting altogether.

It’s important to note that the Kelly Criterion can be pretty aggressive in its bet sizing, which may only be suitable for some players. Some players may prefer to use a “fractional Kelly” approach, betting a smaller percentage of the optimal bet size (e.g., half Kelly or quarter Kelly) to reduce volatility and risk while still taking advantage of the edge provided by card counting.

In summary, using the Kelly Criterion in blackjack involves:

- Determining the player’s edge through card counting.

- Calculating the accurate count.

- Adjusting the bet size based on the optimal fraction of the bankroll.

By doing so, the player can maximize their long-term growth rate while minimizing the risk of ruin, making the Kelly Criterion an invaluable tool in the arsenal of any serious blackjack player.

Stock Market

A study by Victor Haghani and Richard Dewey (2016) compared the performance of the Kelly Criterion to other investment strategies in the stock market. The researchers simulated the returns of the S&P 500 index from 1960 to 2016 and found that the Kelly strategy consistently outperformed other methods. Specifically, the Kelly strategy generated an average annualized return of 11.0%, compared to 9.5% for the equal-weighted system and 8.7% for the market-cap-weighted strategy.

Horse Racing

In a research paper by Mark B. Connelly (2012), the author applied the Kelly Criterion to a dataset of 98,000 horse races in the United States. The study found that a bettor using the Kelly strategy would have achieved a positive return on investment (ROI) of 2.2%, while a fixed bet size strategy would have resulted in a negative ROI of 5.7%. The Kelly bettor’s capital would have grown significantly faster than the fixed bettor’s capital, demonstrating the long-term advantage of using the Kelly Criterion in horse race betting.

The Kelly Criterion is a powerful mathematical tool for optimizing bet sizes and investment allocations to maximize the long-term growth rate of capital. Its applications span various fields, including gambling, investing, and even telecommunications. The formula has proven effective in numerous studies and real-life examples, making it a popular choice among professional gamblers and investors.

However, it is essential to note that the success of the Kelly Criterion relies on accurate estimates of the probabilities and expected returns of bets or investments. In practice, this can be challenging due to the inherent uncertainties in predicting future events. Moreover, the Kelly Criterion’s focus on maximizing long-term growth may only suit some investors, as some may prioritize short-term gains or have different risk tolerance levels. Regardless, the Kelly Criterion remains essential in probability, finance, and decision-making, providing valuable insights into optimal capital management.